College is expensive, guys. You know that, I know that, but seriously. I try to live pretty frugally, and cut costs where I can, so I thought today I’d share some ideas for saving with you guys. I was inspired by finding a really great service called Amazon Underground, and realizing just how many small costs we put up with in our lives. But you know what? We can end a little bit of that today – and we can do it without dramatic life changes.

Simple Ways to Cut the Costs of Student Living

Student Discounts

This seems like the most obvious option, but you’d actually be surprised at how underused student discounts are. Why? Because not all stores advertise them. I would bet actual money that you’ve shopped somewhere with a student discount without using it. But just because you don’t know about a store’s discount, doesn’t mean they don’t have one.

There’s actually a pretty simple solution to this – when you go to checkout, casually ask “Do you guys have a student discount?” It’s not that intimidating, I promise, and the worst that can happen is your cashier saying no – not the end of the world. If there is a discount, though, that’s a few dollars saved.

Savings: Usually around 10%-20% per purchase.

Buy Textbooks Strategically

Textbooks can be a huge expense, so be smart about buying and selling. You have tons of buying options, from the on-campus bookstore, to online marketplaces and rentals, but one sometimes-forgotten option is your fellow students. They took the same classes, so someone on campus is probably selling that book you need. Turn to your friends or even social media to find them!

Your textbooks are a huge investment, so play it smart!

All the options for buying books work for selling them back, but there might be a better idea. Last semester, I had a professor announce that, if you hadn’t purchased all your textbooks yet, one of his former students was selling all their copies. That student is a genius. Be that student, and ask your professor if they’re willing to offer your books up for resale. Again, worst they can say is no.

Savings: Potentially hundreds of dollars every semester.

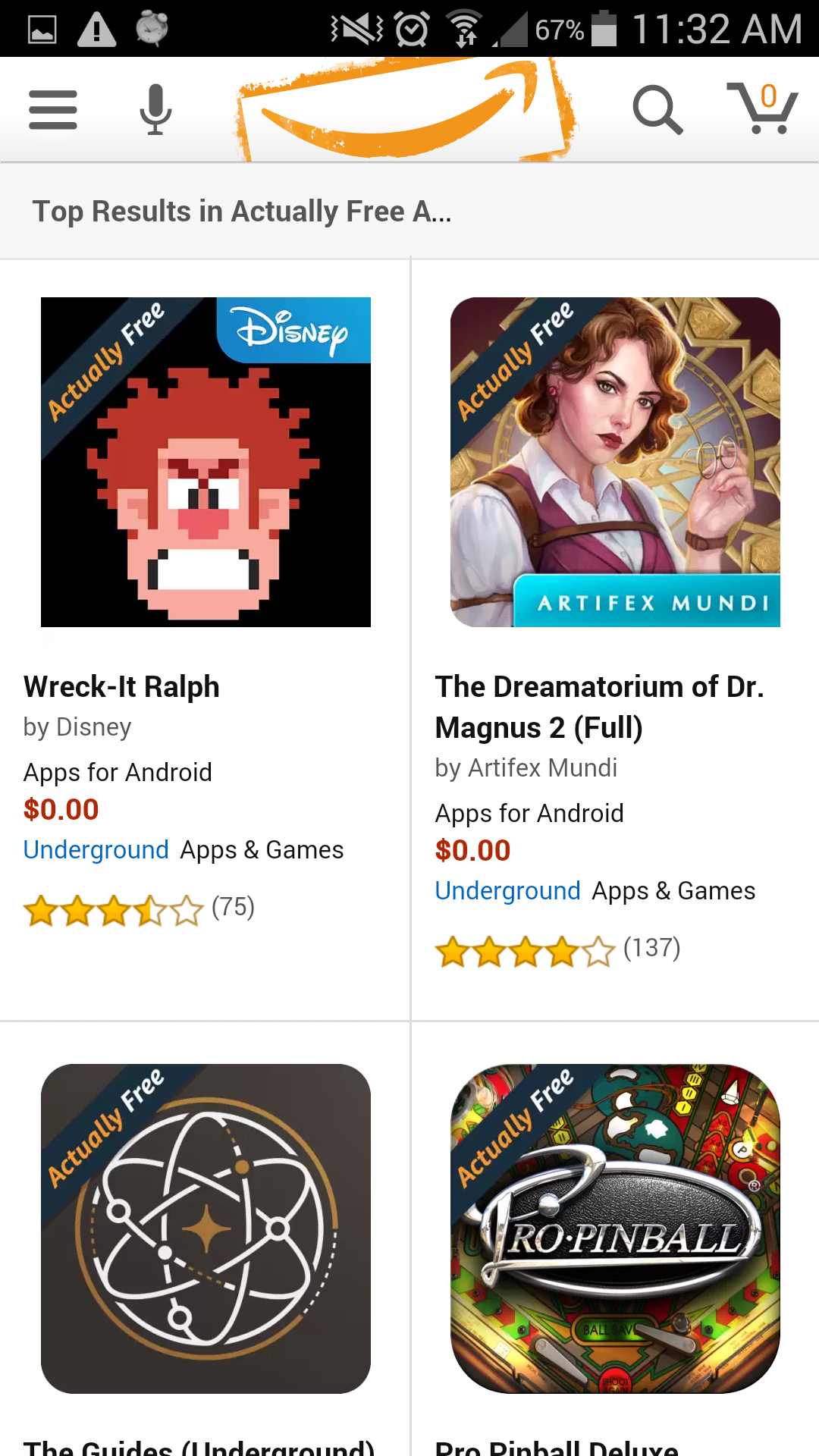

Stop Spending Money On In-App Purchases

If you’ve ever thought “That app looks fun but I don’t want to pay for it,” this one’s for you. Amazon Underground gives you bonuses that aren’t available in the ordinary shopping app, like Amazon video and access to paid apps and in app purchases fo’ free. No, seriously:

Amazon Underground has a constantly-rotating collection of paid apps available for free.

Pay-to-play apps are annoying, especially because they’re addicting. You get a few levels in and start really getting invested in the game… Only to hit a paywall. It’s a really good business model, because the purchases are small – usually no more than a few dollars – which makes you more likely to bite. But all those little purchases can add up over time, and faster than you’d think. If you love a good mobile game, but don’t want to pay through the nose to play, Amazon Underground is a great alternative marketplace.

I decided to throwback to the days of my very first touchscreen device and download an old favorite – Fruit Ninja. And, like most modern apps, Fruit Ninja now lets you buy packs of in-game currency for actual money. But through Amazon Underground, they’re free. Look at this:

That bundle on the far right goes for $49.99, but it’s literally free on Amazon Underground. I don’t know how this works. It may be magic.

I tried it, it’s legit. You’re a college student. Don’t say no to free. You can download the Amazon Underground app for your Android mobile device right here. If you’re on a laptop, though, you’ll want to start here.

Savings: Depends on how much you play games, but some of the in-app purchases free on Amazon Underground would be up to $50 if you actually had to pay for them.

Use Your Dining Plan to Your Advantage

If you have a meal plan, use that sucker. But use it strategically. You’ll probably always buy food outside your meal plan, but that doesn’t mean it can’t save you money. Think about it this way: Healthy food tends to be more expensive. Mac and cheese, pizza, and pasta are pretty cheap foods. You could make them yourself without much investment. Fresh fruit and vegetables, on the other hand, can be pretty pricey.

If you’re eating strategically, you’re getting your more expensive foods, like produce or prime cuts of meat, from the dining hall, and buying those less expensive cravings foods on your own. I also find it’s a great way to keep yourself healthier. I’m a lot more critical of my choice to eat an entire pizza for dinner when I have to pay for the pizza out-of-pocket.

Savings: This one actually blew my mind, guys. One study found that it would cost about $2.18 a day to eat your recommended servings of fruits and vegetables, or about $800 a year.

Don’t change your whole life

This is my last and perhaps most important piece of advice to you. Don’t try to change your entire life and overhaul your budget all at once if you’re not used to those dramatic shifts. It’ll be much harder to stick to a strict regimen, which means you’re more likely to give up and not save much at all. Little changes like these are a great way to get started on financial responsibility, and they don’t require a whole lot of extra effort.

But, like always, none of the information in this post will help you out much if you don’t actually implement it in your lives, so choose a strategy and commit to implementing it today. And let me know in the comments if you’re availing yourself of student discounts, textbook-buying responsibly, downloading Amazon Underground for your Android mobile device, or winning at dining plans! Oh, and if I left out your favorite money-saving tip? Feel free to share it in the comments as well – we’re all in this together!

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.