Alright, guys, it’s time for some real talk. Namely – your financial situation. Mentioning my student loans is a great way to make me shudder. I don’t even want to think about how expensive an American college education is.

But honestly, we all have to deal with the cost of college at one point or another. And while we’re being honest? I wish I’d been better prepared for the process of taking out my loans. I don’t want any of you to have the same regrets, so I teamed up with College Ave Student Loans to share what I wish I had known about paying for college.

Paying For College – What I Wish I’d Known

Get Informed

Promise me something? Please make informed decisions about your finances. College is an enormous investment (and well worth it, if you do it right!) that, unless you’re smart/lucky/talented enough to get a full scholarship for, will probably impact your financial situation for years. Whether you have some scholarship money, parents help, or are financing your education all on your own, making informed, careful choices about how you handle that financial burden is so important.

I’ve heard far too many horror stories about people who were blindsided by money issues. A friend dropped a class and was suddenly considered a part-time student – meaning she had to start paying on her loans, even though she was still in school. So please, however you decide to pay for college, make sure you know what you can and can’t do, and how your choices will affect what you pay.

What Can You Do?

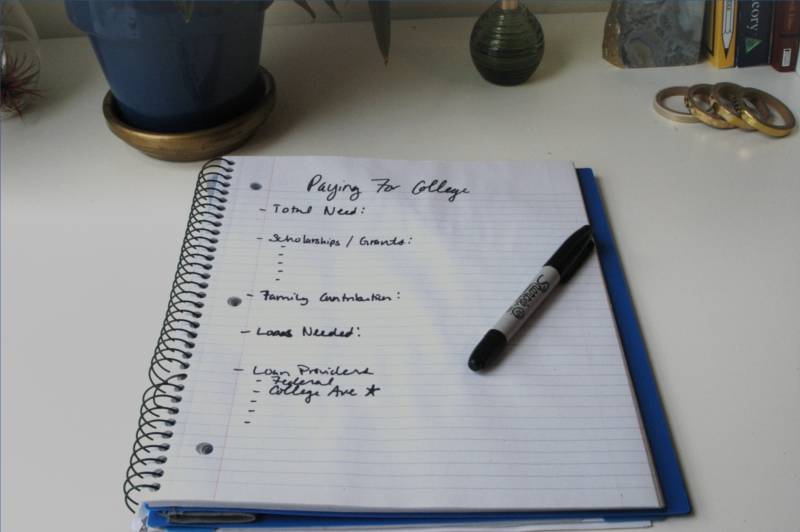

Your FAFSA and your school’s awards letter are a great place to start your search, but don’t assume that the path of least resistance is the only one available to you. Seriously, there are more options out there than you thinks, including College Ave Student Loans. They have undergrad and graduate school loans available, and (as a nice change of pace from the usual complications of paying for college) I found their site easy to navigate and use.

If I’m being honest, I didn’t even consider some independent research when I started looking for loans. I just expected that the path of least resistance (which, in my case, was telling my dad to figure it out) would be the one that saved me the most money. But, if you can excuse a series of terrible puns, you owe it to yourself to make an educated decision.

At the end of the day, explore all the options available to you – there are more of them than you might think.

Know What You’re Getting Into

Remember that friend I mentioned? The one who had to start paying her loans in college? Don’t be her. Whatever loans you decide to take, make sure you know exactly what the terms and conditions are, and exactly what you’re getting into.

This goes for all forms of financing your education. If you’re awarded a scholarship, make sure you know the GPA you need to maintain it, when you need to file paperwork to get it back the next year, and what other stipulations you’ll need to fulfill to keep it.

I think the most important thing you can do, when figuring out how to pay for college, is actually look at the numbers. I know this is intimidating (I’m an English major, I swore off math years ago), but knowing exactly where you stand financially is the best way to avoid nasty surprises down the line.

That’s one thing I appreciated about College Ave’s site. They provide a great tool for tracking how much your loan will cost over its lifetime, allowing you to adjust things like payment timetables and payments made while in school to understand the true cost of the loan. This is the kind of information that’s absolutely essential to making your financial decisions.

The Bottom Line

Paying for college isn’t a one-size issue. Your unique financial situation and need will require some special attention, and that’s okay. If there’s one thing that you take from this post, I want it to be a reminder to explore your options, even when the concept terrifies you. It’s better to be overwhelmed by information now than get blindsided by it later, trust me.

So if you’re looking for a way to pay for your education, I have a challenge for you today. Learn about one option for paying for college you haven’t heard of before. Whether it’s a new scholarship, College Ave Student Loans, or something else entirely, learn something new today. Future-you will be grateful you did.

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.